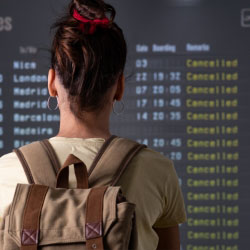

We all know "it" happens - have a guardian by your side

Whether you are looking for a Quote, wanting to talk to a Representative, or you are READY TO BUY NOW! Travel Guardian is here for all of life's suprises while travelling. Simply choose the form options below and we will have you on the right path to a safer tomorrow.